The best budgeting tool depends on your personal preferences and financial goals. Consider your budgeting style, the features you need, and your budget when choosing between Monarch Money and YNAB.

Budgeting Showdown: Monarch Money vs. YNAB

Core Philosophies

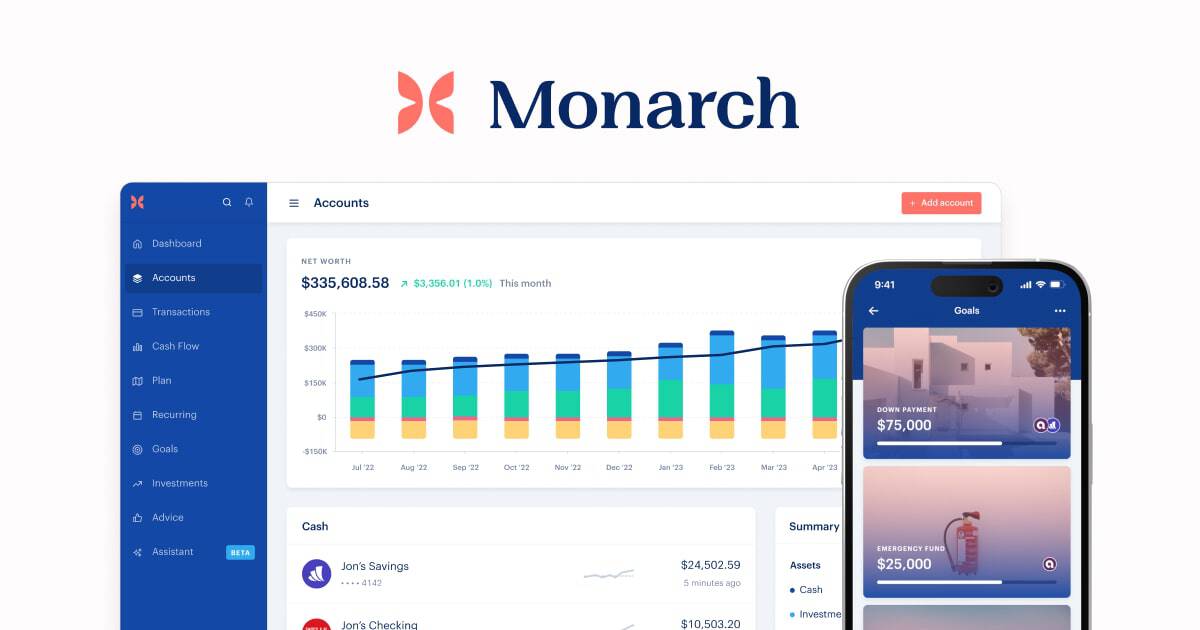

- Monarch Money: This platform emphasizes a holistic view of your finances. It connects all your accounts in one place, tracking spending, net worth, and investments. It promotes financial awareness and encourages a “big picture” approach to money management.

- YNAB (You Need A Budget): This tool follows the zero-based budgeting method. It encourages users to give every dollar a job, ensuring all income is allocated to expenses, savings, or debt payments. This approach promotes mindful spending and active budgeting.

Key Features

| Feature | Monarch Money | YNAB |

|---|---|---|

| Budgeting Method | Holistic, Envelope-Style | Zero-Based Budgeting |

| Account Aggregation | Yes | Yes |

| Bill Tracking | Yes | Yes |

| Investment Tracking | Yes | Limited |

| Debt Management Tools | Yes | Yes |

| Reports and Insights | Yes | Yes |

| Mobile App | iOS and Android | iOS and Android |

| Free Trial | Yes | Yes (34-day trial) |

Unique Strengths

- Monarch Money: Offers a comprehensive view of your financial life, including investments and net worth. Provides personalized insights and recommendations for financial goals.

- YNAB: Strong focus on budgeting discipline with its zero-based approach. Provides a clear structure for managing income and expenses. Emphasizes debt payoff strategies.

Pricing

- Monarch Money: Offers a free version with limited features and a premium subscription for $9.99 per month or $99.99 annually.

- YNAB: Offers a free trial for 34 days. After the trial, it costs $14.99 per month or $98.99 annually.

Who Should Use Each Tool?

- Monarch Money: Ideal for those who want an all-in-one financial management tool that tracks their spending, net worth, and investments.

- YNAB: Perfect for individuals who are looking for a structured budgeting approach and want to actively manage their income and expenses.

Overview of Monarch Money and YNAB

Monarch Money is a financial management tool aimed at simplifying personal finances. It offers features like investment tracking and helps users get a clear picture of their cash flow and net worth. Unlike some budgeting apps, it doesn’t require users to link their transactions directly to their budgets, which can be both an advantage and a limitation, depending on how you like to manage your money.

You Need A Budget (YNAB) adopts a zero-based budgeting philosophy, where every dollar is given a purpose. It’s designed to help users allocate their money diligently and spend less than they make each month. This process encourages a proactive approach to budgeting and emphasizes financial awareness.

| Feature | Monarch Money | YNAB |

|---|---|---|

| Budgeting Philosophy | Focus on monthly cash flow and net worth | Zero-based budgeting, allocating every dollar |

| Financial Tracking | Includes investments, loans, and assets | Mainly focused on budgeting and expenses |

| Customization | Customizable dashboard for personal view | Templates for budgeting needs |

| Price | Varied pricing models | $14.99 monthly or $99 annually |

| Trial | N/A | 34-day free trial |

YNAB’s budgeting app is known for its structured approach, but it can have a steep learning curve. Users dedicate time to learn its system, which could result in significant control over their budgets. Monarch Money, on the other hand, takes a broader view of personal finances and may appeal more to those who have diverse portfolios and want easier oversight with a less hands-on budgeting approach.

Both tools offer different takes on managing money and can cater to a variety of personal preferences and financial scenarios. Deciding which one is right depends on individual needs regarding budgeting discipline, financial tracking, and the desire for a more comprehensive or focused tool.

Features and Usability

When comparing Monarch Money and YNAB, it’s important to note how each platform performs in various aspects ranging from user interface to budgeting prowess, offering insights into their practicality and efficiency.

Interface and Experience

Monarch Money and YNAB provide clean and straightforward interfaces for users. YNAB offers a detail-oriented dashboard that allows for easy navigation and budget management, while Monarch Money’s design is equally user-friendly with an emphasis on visual simplicity. Both services have mobile apps that are designed to be responsive and easy to use.

Budgeting and Expense Tracking

Both platforms allow users to categorize their expenses and create detailed budgets. YNAB uses the zero-based budgeting method, which means every dollar gets a job, making it excellent for meticulous financial planning. Monarch Money approaches budgeting with a focus on monthly cash flow, and while it doesn’t tie budgeting to individual transactions, it still offers robust tracking tools.

Planning and Goals

With YNAB, users can set and manage financial goals, which aids in long-term financial planning. Monarch Money also supports goal setting, but it leans more towards monthly cash flow and savings management rather than detailed forecasted budgeting.

Support and Education

YNAB provides a wide array of educational resources and customer support options, including detailed guides and live workshops. Monarch Money also offers customer support, but it may not have as extensive an educational component as YNAB.

Integrations and Compatibility

Both tools connect with financial institutions using services like Plaid to sync with bank accounts. YNAB has broad integration with thousands of financial institutions and supports various platforms. Monarch Money is also designed for multiple operating systems and offers extensive bank connectivity.

Pricing and Value

Monarch Money costs $14.99 per month or $99.99 for a year, whereas YNAB offers different pricing models. Users need to consider the cost relative to the features they are getting, such as investment tracking and personalized categories, to determine which offers better value.

Customization and Flexibility

Customization is where YNAB shines, letting users tailor categories perfectly to their needs. Monarch Money is flexible in monthly planning but may lack the level of customization that YNAB offers for budgeting categories.

Understanding Financial Health

Both platforms provide reports and overviews that help users understand their financial health. YNAB focuses on giving a comprehensive financial dashboard, while Monarch Money helps users keep tabs on their net worth and cash flow.

Investment and Savings Management

YNAB excels in investment tracking, providing tools to overview your complete financial portfolio. On the other hand, Monarch Money includes investment features, but YNAB may offer a more detailed approach suitable for users who want to intertwine budgeting with investment oversight.

Account and Subscription Management

Users can manage their subscriptions and accounts directly through the apps. Both platforms offer straightforward account administration, with Monarch Money providing a 30-day money-back guarantee for annual memberships

Security and Privacy

Privacy and security are paramount for both services, which use encryption and other measures to protect user data. Users can confidently manage their finances knowing their sensitive information is secured and their privacy is maintained.

Comparing Monarch Money to Other Budgeting Tools

Monarch Money has carved out its place in the world of personal finance management, but how does it stack up against other budgeting tools? Let’s break down their similarities, unique features, typical users, expert opinions, and the key factors that guide user choices.

Similarities with Other Apps

Monarch Money shares several features with top budgeting apps, such as providing spending insights, helping users achieve financial goals, and managing personal finances. Like alternatives including Rocket Money and Quicken Simplifi, Monarch Money offers users an overview of their financial health.

Differences from Alternatives

The primary differences from other budgeting apps are in Monarch’s design and functionality. Unlike YNAB, which employs a zero-based budgeting philosophy, Monarch aims for a broader approach to financial management. This contrasts with simpler tools like Mint alternatives, which are primarily focused on budgeting without extensive investment tracking features.

Target Audience and Use Cases

Monarch Money and YNAB cater to different user groups. Monarch is often preferred by those looking for a robust personal finance app that can adapt to a variety of needs, including couples and families who value the collaboration features. In contrast, YNAB offers a more intensive budgeting experience preferred by users with specific budgeting strategies.

Analyzing Expert Reviews

Expert reviews of Monarch underscore its strengths as a comprehensive personal finance tool and a Mint alternative. Publications like ZDNET have rated it highly among peers like NerdWallet and Rocket Money for its all-in-one approach to tracking financial status and offering actionable insights.

Decision Factors for Users

When deciding on Monarch Money or other budgeting tools, users consider several factors:

- Monthly/Annual Cost: Monarch is priced competitively with an annual rate, while others like YNAB offer monthly pricing.

- Ease of Use: Monarch is often recognized for its intuitive interface in comparison to YNAB, which may have a steeper learning curve.

- Feature Set: Users looking for simple budgeting might choose simpler apps, while those seeking comprehensive tools lean towards Monarch.

- Collaboration: Families and couples might prefer Monarch for shared finance management options, which might not be a focus of all personal finance software.

Frequently Asked Questions

When choosing a budgeting tool, it’s crucial to consider your financial goals and habits. Below are some common inquiries regarding Monarch Money and YNAB which highlight their budgeting features, costs, and overall financial management capabilities.

How does Monarch Money’s budgeting features compare to YNAB’s methodology?

Monarch Money offers a comprehensive dashboard that simplifies monitoring of accounts and expenses, while YNAB focuses on a zero-based budgeting system that requires a more active role in tracking every dollar.

What is the cost difference between using Monarch Money and YNAB?

Monarch Money’s annual cost is typically $99, which positions itself as a premium product. YNAB has a different pricing strategy which may vary; therefore, users should check the current pricing to compare.

Can Monarch Money serve as a viable alternative to Mint for budgeting and financial tracking?

Yes, Monarch Money can replace Mint for users seeking advanced budgeting features and a more streamlined interface for managing finances.

Which service offers better financial insights, Monarch Money or Empower?

Monarch Money is often preferred for its extensive tools and easy setup, making it a strong contender for providing superior financial insights compared to Empower.

How do user experiences with Monarch Money differ from those using Copilot for financial management?

Users of Monarch Money often appreciate its all-in-one approach to budgeting and investment tracking, whereas Copilot users may experience a more targeted tool for financial management.

Between Monarch Money and Rocket Money, which app provides more comprehensive budgeting tools?

Monarch Money generally offers a broader range of budgeting tools and is well-regarded for its ability to help users manage expenses and savings effectively compared to Rocket Money.