Choosing the right budgeting app can make a big difference in managing your money. Monarch Money and Rocket Money are two popular options that offer unique features to help you track spending and reach financial goals. Monarch Money costs $8.33 per month when paid annually, while Rocket Money has a flexible pricing model that can be cheaper for some users.

Both apps provide tools for budgeting, expense tracking, and financial goal-setting. Monarch Money stands out with its clean interface and powerful reporting features. Rocket Money focuses on finding and canceling unwanted subscriptions, which can save you money each month.

Your choice between these apps may depend on your specific needs. If you want detailed financial reports and don’t mind paying a set price, Monarch Money might be the better fit. If you’re looking to cut costs and don’t need advanced features, Rocket Money could be more suitable.

Monarch Money vs. Rocket Money: Choosing the Right Financial Companion

Monarch Money and Rocket Money are two popular personal finance apps designed to help you manage your money more effectively. While both aim to simplify your financial life, they have distinct features and cater to different needs. This comparison will help you determine which app is the right fit for your financial goals.

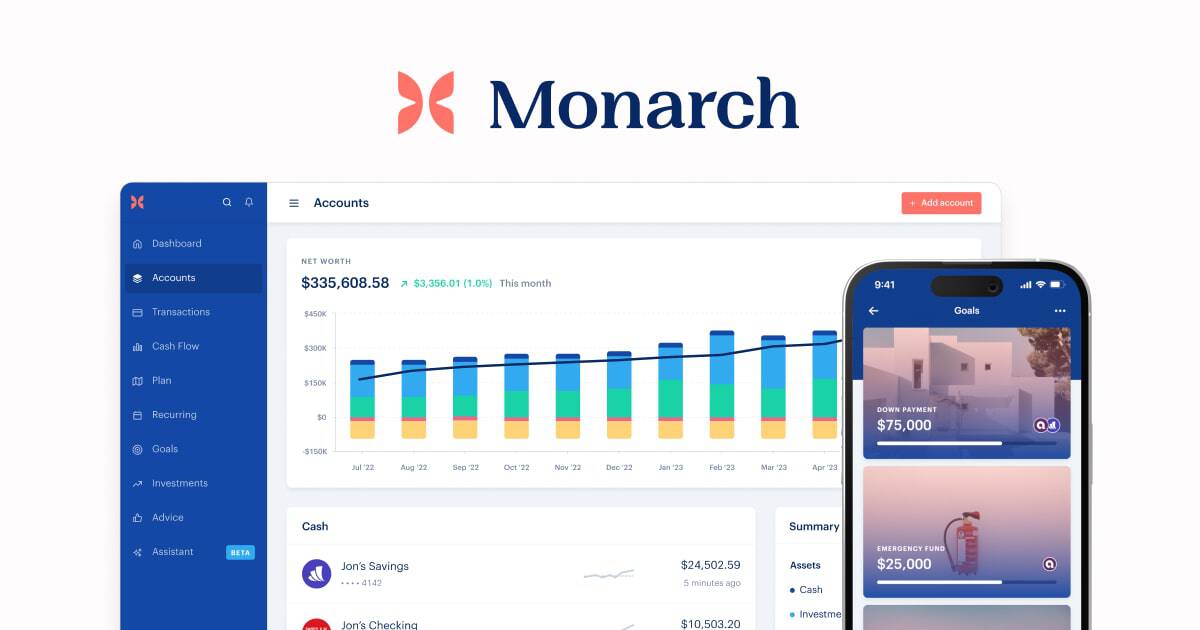

Monarch Money: Comprehensive Financial Management

Monarch Money takes a holistic approach to personal finance, offering a wide range of features, including:

- Budgeting: Create detailed budgets, track your spending, and set financial goals.

- Net Worth Tracking: Monitor your overall financial health by tracking your assets and liabilities.

- Investment Tracking: Connect your investment accounts to track your portfolio’s performance.

- Fee Analysis: Identify and potentially reduce hidden fees associated with your financial accounts.

Monarch Money excels at providing a comprehensive overview of your finances, making it ideal for users who want to delve deep into their financial situation and optimize their spending and saving habits.

Rocket Money: Focus on Savings and Automation

Rocket Money prioritizes helping you save money and automate your finances. Its key features include:

- Subscription Management: Easily identify and cancel unwanted subscriptions.

- Bill Negotiation: Rocket Money can negotiate lower bills on your behalf with service providers.

- Smart Savings: Automatically set aside money for savings goals based on your spending patterns.

- Credit Score Monitoring: Track your credit score and receive alerts about changes.

Rocket Money is a great choice for users who want to take a more hands-off approach to managing their finances and are primarily focused on saving money and reducing expenses.

Key Differences

Here’s a table summarizing the key differences between Monarch Money and Rocket Money:

| Feature | Monarch Money | Rocket Money |

|---|---|---|

| Budgeting | Comprehensive budgeting tools with detailed categorization | Basic budgeting features |

| Net Worth Tracking | Yes | Limited |

| Investment Tracking | Yes | No |

| Fee Analysis | Yes | No |

| Subscription Management | No | Yes |

| Bill Negotiation | No | Yes |

| Smart Savings | No | Yes |

| Credit Score Monitoring | No | Yes |

| Free Version | No | Yes (with limited features) |

Choosing the Right App

The best app for you depends on your individual needs and preferences.

- Choose Monarch Money if:

- You want a comprehensive view of your finances, including budgeting, net worth tracking, and investment tracking.

- You’re comfortable with a more hands-on approach to managing your money.

- You’re willing to pay for a premium subscription.

- Choose Rocket Money if:

- You want help saving money and automating your finances.

- You prioritize features like subscription management and bill negotiation.

- You prefer a free app or a less expensive subscription.

Key Takeaways

- Monarch Money offers more features at a fixed price of $8.33 per month when paid yearly

- Rocket Money has a flexible pricing model and focuses on cutting unnecessary subscriptions

- Your choice depends on whether you need detailed reports or simple cost-cutting tools

Overview of Monarch Money and Rocket Money

Monarch Money and Rocket Money are financial management apps that help users track spending, create budgets, and manage investments. Both offer unique features to improve personal finances.

Services and Features

Monarch Money focuses on budgeting and investment tracking. Users can link bank accounts, credit cards, and investment portfolios. The app creates custom budgets based on spending habits. It also tracks net worth and provides investment insights.

Rocket Money offers bill and subscription management. It finds and cancels unwanted subscriptions. The app also tries to lower bills by negotiating with service providers. Rocket Money includes a free credit score monitoring feature.

Both apps send alerts for unusual spending or low account balances. They also offer reports on spending trends and financial goals.

Supported Platforms and Integrations

Monarch Money works on desktop computers and mobile devices. It has apps for iOS and Android. The platform connects to over 11,000 financial institutions.

Rocket Money is mainly a mobile app. It’s available for both iPhone and Android phones. The app links to most major banks and credit card companies in the U.S.

Both apps use bank-level encryption to protect user data. They offer two-factor authentication for added security. Neither app can make transactions or move money between accounts.

Comparative Analysis

Monarch Money and Rocket Money offer different approaches to personal finance management. Each app has unique features for budgeting, tracking, and financial goal-setting.

User Interface and Customization

Monarch Money has a clean, easy-to-use interface. Users can customize their dashboard to show the most important financial information. The app allows for personalized categories and tags for transactions.

Rocket Money’s interface is also user-friendly. It focuses on showing users where they can save money. The app highlights subscriptions and recurring charges that might be unnecessary.

Both apps link to various financial institutions. This lets users see all their accounts in one place. Monarch Money offers more customization options for reports and views.

Budgeting and Financial Tracking

Monarch Money uses a zero-based budgeting system. This method assigns every dollar a job. The app tracks spending and shows how it compares to the budget.

Rocket Money puts emphasis on cutting costs. It finds ways to lower bills and cancel unused subscriptions. The app also offers budgeting tools, but they are not as detailed as Monarch Money’s.

Both apps help users set and track financial goals. They can monitor progress towards savings targets or debt payoff plans. Monarch Money provides more in-depth analysis of spending patterns over time.

Pricing and Value

Monarch Money costs $99 per year. This is a flat fee for all features. There is no free version, but they offer a trial period.

Rocket Money has a free basic plan. Their premium features use a “pay what’s fair” model. Users can choose how much to pay within a set range.

Monarch Money may offer better value for those who want detailed budgeting tools. Rocket Money could be more appealing to users looking to cut costs quickly.

Both apps provide bill negotiation services. Rocket Money takes a percentage of the money saved as a fee. Monarch Money includes this in the yearly subscription cost.

Frequently Asked Questions

Monarch Money and Rocket Money offer different features, pricing, and security measures. Let’s explore the key aspects of these personal finance apps to help you choose the right one for your needs.

What are the main differences between Monarch Money and Rocket Money?

Monarch Money focuses on comprehensive financial planning. It offers investment tracking and budgeting tools. Rocket Money emphasizes bill negotiation and subscription management. It helps users cut costs on existing expenses.

How do the features of Monarch Money compare to those of Rocket Money?

Monarch Money provides a wider range of financial tools. It includes cash tracking, investment monitoring, and budgeting. Rocket Money specializes in expense reduction. It offers zero-based budgeting and helps users avoid unnecessary spending.

What are the pricing models for Monarch Money and Rocket Money?

Monarch Money charges $8.33 per month when billed annually. Rocket Money uses a sliding scale pricing model. Users can choose to pay between $6 and $12 monthly. Rocket Money also offers a free seven-day trial.

Can Monarch Money and Rocket Money integrate with other financial tools?

Both apps can connect to various financial institutions. Monarch Money links to a network of 11,000 banks. Rocket Money also integrates with many banks and credit card companies to track expenses and income.

How do Monarch Money and Rocket Money ensure the security of personal financial information?

Monarch Money uses bank-level encryption to protect user data. Rocket Money also employs strong security measures to safeguard financial information. Both apps use secure connections when syncing with financial institutions.

Do Monarch Money and Rocket Money offer credit score tracking services?

Rocket Money provides credit score monitoring as part of its features. Monarch Money focuses more on overall financial management and may not include credit score tracking. Users should check the latest app versions for the most up-to-date information on credit monitoring services.