Choosing the right personal finance software can make a big difference in managing your money. Two popular options are Monarch Money and Quicken. Both tools help track spending, set budgets, and plan for the future. But they have some key differences.

Monarch Money offers a modern, user-friendly interface with strong budgeting features, while Quicken provides more comprehensive financial tracking and analysis tools. Monarch Money costs $99 per year and works well for those focused on budgeting and goal-setting. Quicken has several pricing tiers starting at $35.99 per year and may be better for users who want detailed investment tracking or small business features.

Both apps can link to your bank accounts and credit cards to import transactions automatically. They also provide reports and insights to help you understand your spending habits. Your choice may depend on which features matter most to you and how much you’re willing to spend.

Monarch Money and Quicken Simplifi are both popular personal finance software options, but they have some key differences that might make one a better fit for you than the other. Here’s a comparison:

Monarch Money

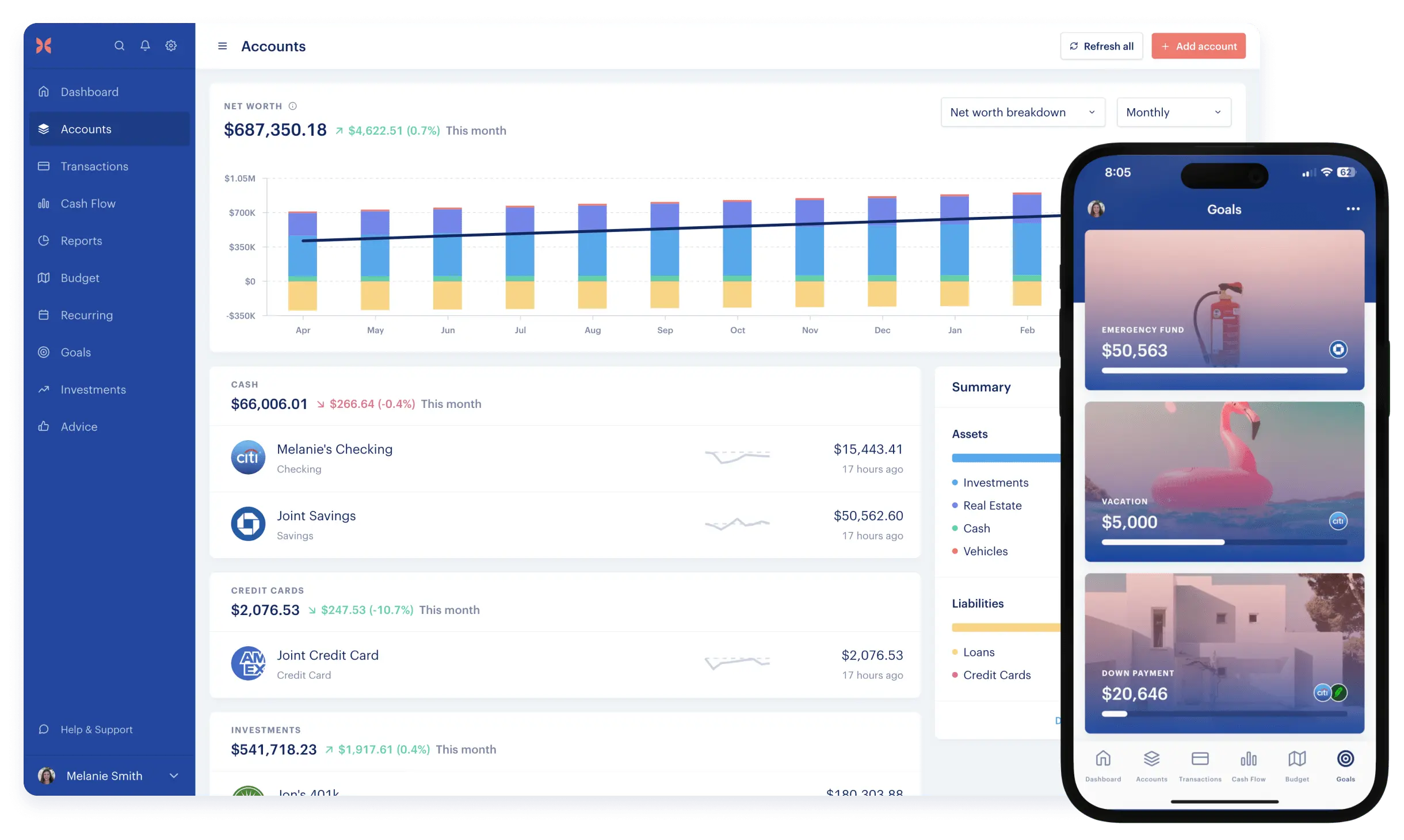

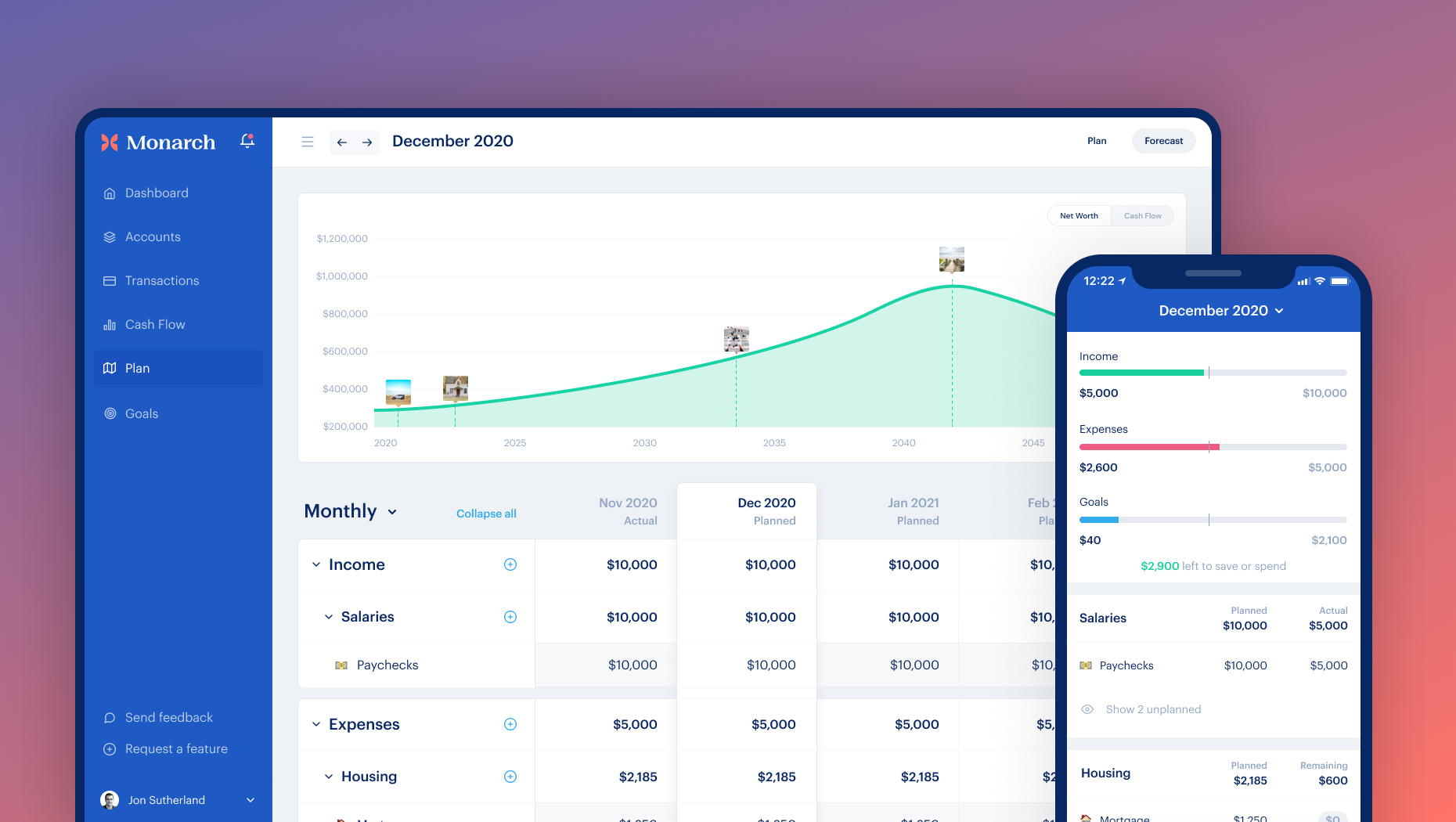

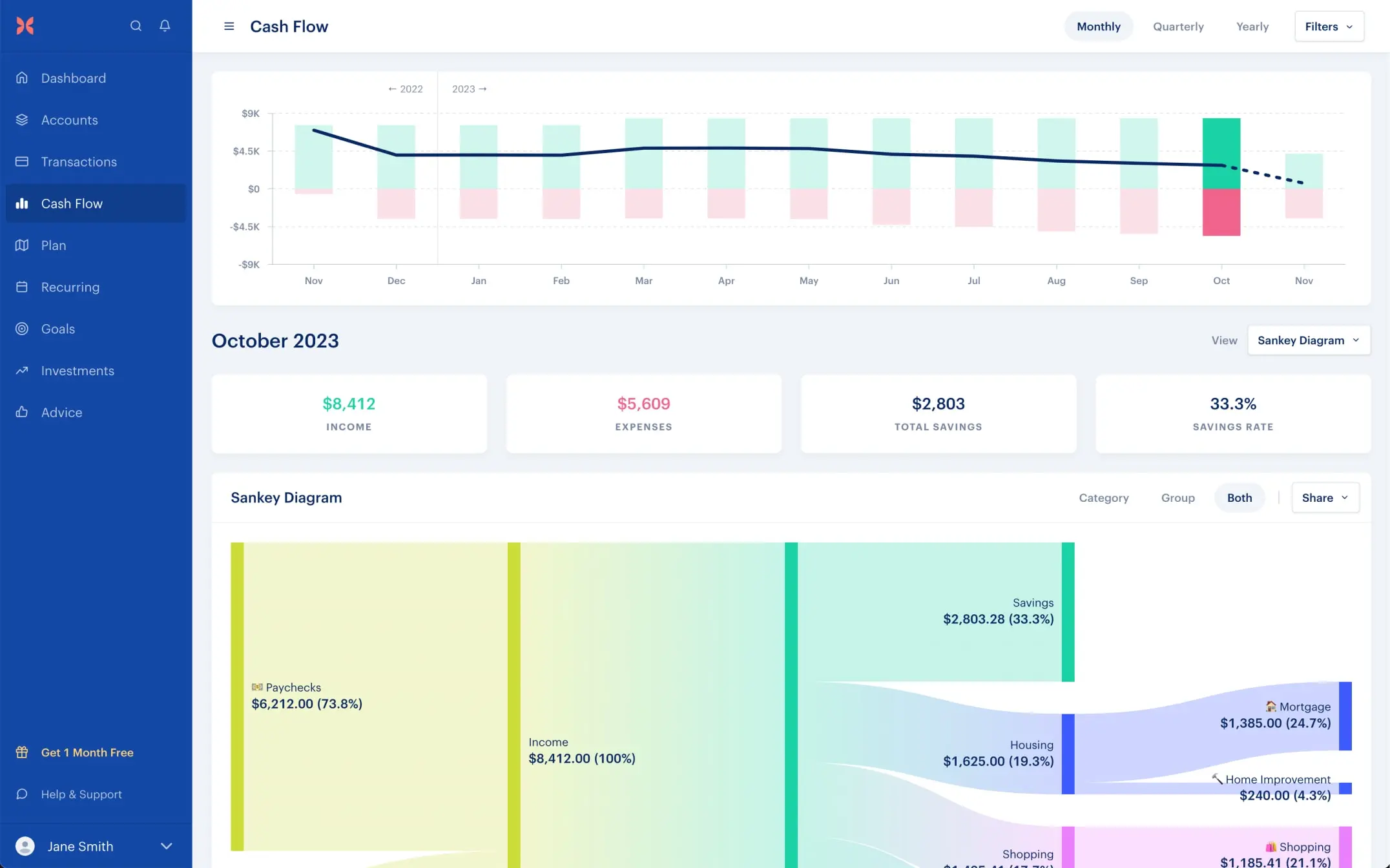

- Focus: Provides a comprehensive view of your finances, including budgeting, net worth tracking, and investment monitoring.

- Strengths:

- Excellent net worth tracking: Automatically connects to your accounts to provide a real-time view of your net worth.

- Strong budgeting tools: Offers flexible budgeting options, including the ability to set spending targets and track progress.

- Investment tracking: Monitors your investment performance and provides insights into your portfolio.

- Subscription management: Helps you identify and cancel unwanted subscriptions.

- Weaknesses:

- Limited free version: The free version is very basic.

- No manual account entry: You can only connect to accounts that Monarch supports.

- Fewer budgeting features than Quicken Simplifi: Lacks some of the advanced budgeting features found in Quicken Simplifi.

Quicken Simplifi

- Focus: Simplifies budgeting and helps you track spending and save money.

- Strengths:

- Robust budgeting features: Offers a wide range of budgeting tools, including customizable categories, spending projections, and watchlists.

- Goal setting: Helps you set and track financial goals.

- Excellent free trial: Offers a 30-day free trial to test out the features.

- Weaknesses:

- Less comprehensive than Monarch Money: Doesn’t offer as many features for net worth tracking and investment monitoring.

- Can be overwhelming for beginners: The interface can be a bit cluttered with features.

Here’s a table summarizing the key differences:

| Feature | Monarch Money | Quicken Simplifi |

|---|---|---|

| Pricing | $99/year or $14.99/month | $59.99/year or $6.99/month |

| Free version | Limited | 30-day free trial |

| Net worth tracking | Excellent | Good |

| Budgeting tools | Good | Excellent |

| Investment tracking | Yes | Limited |

| Subscription management | Yes | No |

| Manual account entry | No | Yes |

Which one should you choose?

- Choose Monarch Money if: You want a comprehensive overview of your finances, including net worth and investments, and are willing to pay for a premium service.

- Choose Quicken Simplifi if: You’re primarily focused on budgeting and saving money, and want a wide range of budgeting tools.

Ultimately, the best choice depends on your individual needs and preferences. I recommend trying both out (Monarch has a limited free version and Quicken Simplifi has a free trial) to see which one you prefer.

Key Takeaways

- Monarch Money focuses on budgeting and goal-setting with a modern interface

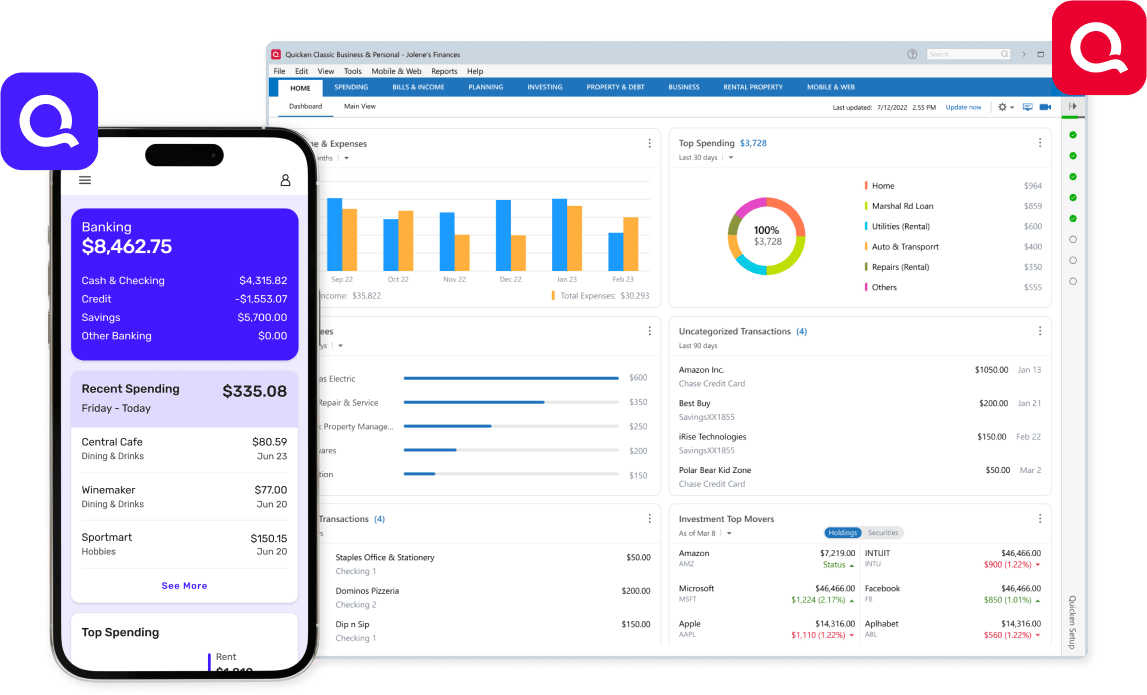

- Quicken offers more detailed financial tracking and analysis tools

- Your choice depends on your specific needs and budget for personal finance software

Comparing Features and User Experience

Monarch Money and Quicken offer different tools for managing personal finances. Both apps have strengths in budgeting, investment tracking, and financial insights.

Budgeting and Financial Goals

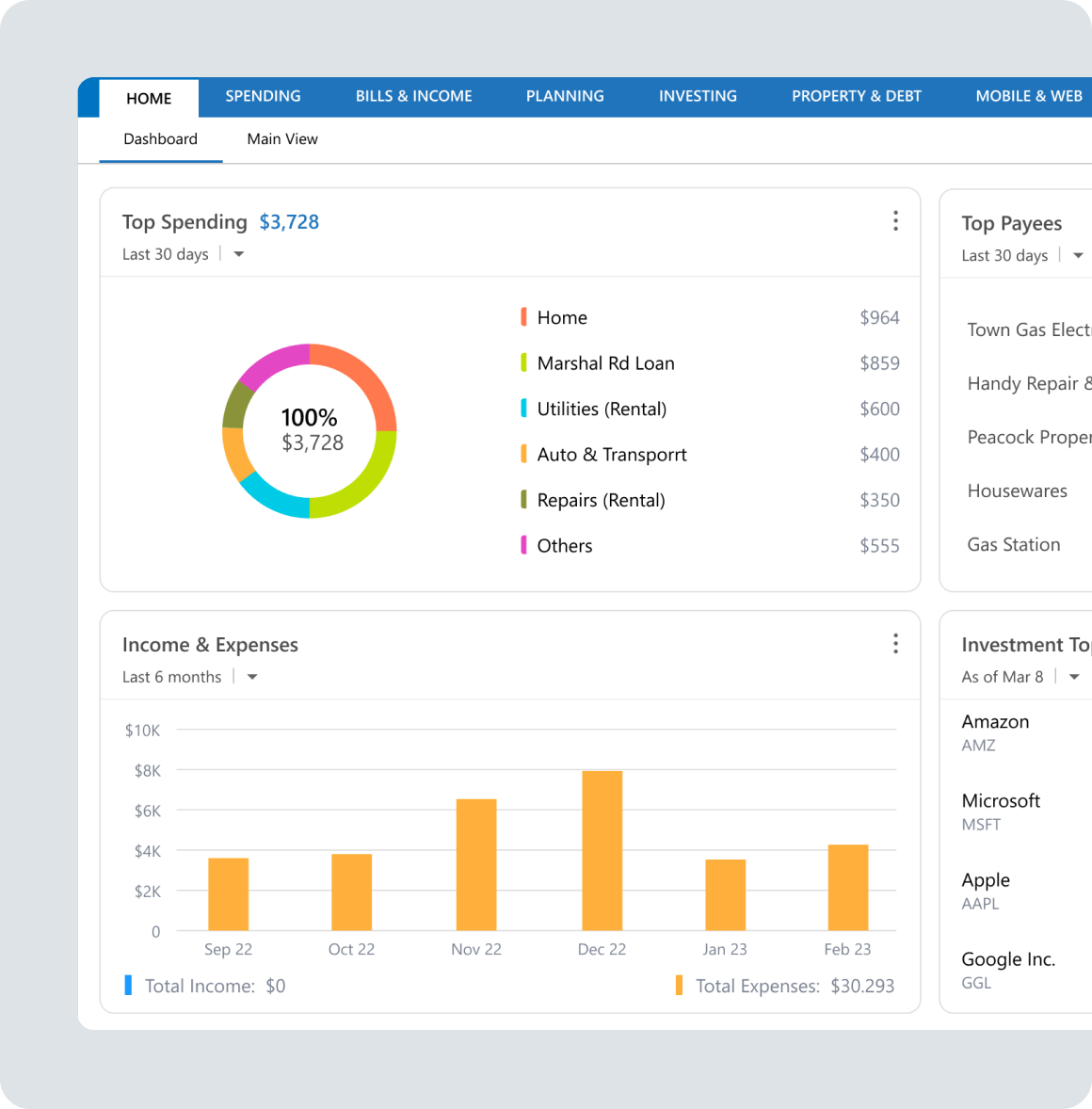

Quicken provides detailed budgeting tools with many options for customization. Users can set up complex budgets with multiple categories and subcategories. Quicken also offers zero-based budgeting for those who want to assign every dollar a job.

Monarch Money takes a simpler approach to budgeting. It focuses on easy-to-use features and a clean interface. Users can set financial goals and track progress over time. Monarch’s budgeting system is more flexible, allowing for quick adjustments.

Both apps allow users to link bank accounts and credit cards. This makes tracking expenses and income automatic. Quicken has more advanced features for categorizing transactions, while Monarch Money aims for a smoother user experience.

Investment Tracking and Analysis

Quicken shines in investment tracking and management. It offers detailed portfolio analysis, including performance metrics and asset allocation. Users can track stocks, bonds, mutual funds, and other investments.

Monarch Money provides basic investment tracking features. It shows users their overall portfolio value and performance. The app focuses on simplicity, making it easy for beginners to understand their investments.

Both apps allow users to link investment accounts for automatic updates. Quicken offers more in-depth analysis tools, while Monarch Money keeps things straightforward.

Mobile Accessibility and Alerts

Monarch Money puts a strong focus on mobile accessibility. Its app is designed to be user-friendly and works well on smartphones. Users can easily check their finances on the go.

Quicken also offers a mobile app, but it may not be as smooth as Monarch Money’s. Some users find Quicken’s mobile experience less intuitive than its desktop version.

Both apps send alerts for important financial events. These can include low balance warnings, bill reminders, and unusual spending notifications. Monarch Money’s alerts tend to be more customizable and user-friendly.

Reports and Financial Insights

Quicken excels in generating detailed financial reports. Users can create custom reports on spending, income, investments, and taxes. These reports can be very helpful for tax preparation and financial planning.

Monarch Money offers simpler reports focused on overall financial health. It provides insights into spending patterns and progress towards goals. The app aims to give users a clear picture of their finances without overwhelming them with data.

Both apps use the data they collect to offer financial insights. Quicken’s insights tend to be more detailed, while Monarch Money focuses on actionable tips for improving financial health.

Cost Considerations and Customer Support

Monarch Money and Quicken have different pricing models and customer support options. These factors can affect which tool is best for managing personal finances.

Pricing Models and Free Trials

Monarch Money charges $99.99 for a yearly plan or $14.99 per month. It offers a 7-day free trial for new users to test the service.

Quicken has four pricing tiers. These range from $2.39 to $5.99 per month. Quicken also provides a 30-day money-back guarantee.

Quicken Simplifi, a related product, costs $5.99 monthly or $71.88 yearly. This makes it cheaper than Monarch Money.

Neither Monarch Money nor Quicken has a free version. Both require payment after the trial period ends.

Customer Support and External Reviews

Monarch Money offers customer support, but details about their support channels are limited. Users can likely reach out through the app or website for help.

Quicken has mixed reviews from users. It has a low rating with the Better Business Bureau. This may point to issues with customer service or product quality.

Despite this, Quicken is known for its detailed investment tracking and in-depth budgeting tools. These features may outweigh customer service concerns for some users.

When choosing between the two, consider both price and support quality. Think about which features matter most for your financial management needs.

Frequently Asked Questions

Monarch Money and Quicken are popular personal finance tools with distinct features and pricing. Let’s explore key differences and considerations when choosing between them.

What are the main differences between Monarch Money and Quicken in terms of features?

Monarch Money offers an intuitive, all-in-one dashboard for managing finances. It excels at joint finance management for couples and customizable budgeting.

Quicken provides detailed investment tracking and management. It also has extensive budgeting and reporting tools, plus in-depth transaction categorization.

Can you compare the cost of Monarch Money with that of Quicken?

Monarch Money costs $99 per year. Quicken offers four pricing tiers ranging from $2.39 to $5.99 per month.

Both apps provide free trials. Neither has a free version.

How does Monarch Money’s user experience compare to that of Quicken Simplifi?

Monarch Money is known for its feature-rich platform and easy setup process. Quicken Simplifi aims for simplicity in its interface.

Both apps focus on user-friendly design, but Monarch Money may offer more tools and customization options.

What are the privacy policies of Monarch Money regarding selling user data?

Monarch Money uses bank-level security to encrypt all data on its site. They have restrictive policies to protect user information.

The app does not sell user data to third parties.

Is there a way to transfer financial data from Quicken to Monarch Money?

Direct data transfer between Quicken and Monarch Money is not currently available. Users may need to manually input their financial information when switching platforms.

Some financial institutions allow exporting data, which can then be imported into the new app.

What are the advantages of using Monarch Money over Quicken for personal finance management?

Monarch Money shines in joint finance management and offers a sleek, modern interface. Its all-in-one dashboard provides a comprehensive financial overview.

The app’s customizable budgeting features allow users to tailor their financial planning. Monarch Money also receives regular updates to improve functionality.