Monarch Money and Copilot are both powerful personal finance tools with unique strengths. Monarch Money shines with its comprehensive approach, offering in-depth budgeting, investment tracking, and net worth monitoring features. It’s ideal for those who want a detailed overview of their finances and enjoy delving into the nitty-gritty of their financial data. Copilot, on the other hand, prioritizes simplicity and user experience, focusing on visual budgeting, spending trends, and automated suggestions for improvement. It’s a great choice for those who prefer a more streamlined and hands-off approach to money management. Ultimately, the best app for you depends on your individual preferences and financial goals.

Comparing Personal Finance Apps: Monarch Money vs. Copilot

Core Features

Both Monarch Money and Copilot offer a suite of tools to help you manage your finances, but they have different strengths:

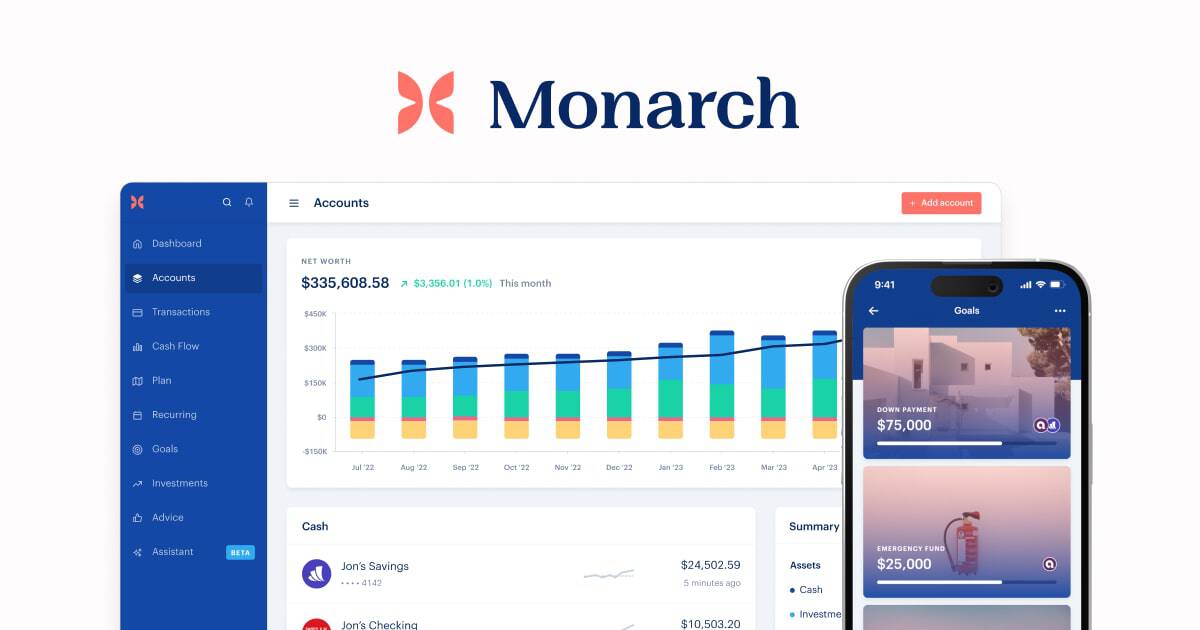

- Monarch Money: Excels in detailed budgeting, investment tracking, and net worth monitoring. It provides a comprehensive overview of your financial picture.

- Copilot: Offers a more streamlined and visually appealing interface, focusing on budgeting and expense tracking. It’s great for those who prefer simplicity.

Budgeting and Expense Tracking

- Monarch Money: Allows for granular budgeting with custom categories and rules, automatic categorization, and spending insights.

- Copilot: Features a visual budget dashboard, spending trends analysis, and personalized recommendations for improving your budget.

Investment Tracking and Net Worth

- Monarch Money: Provides comprehensive investment tracking across various accounts, including retirement, brokerage, and crypto. It also offers a detailed net worth tracker.

- Copilot: Offers basic investment tracking and net worth monitoring, but it’s not as in-depth as Monarch Money.

Additional Features

- Monarch Money: Includes features like recurring bill reminders, shared finances (for couples), and a robust knowledge base for financial education.

- Copilot: Offers a unique “autopilot” feature that suggests budget adjustments based on your spending patterns, and a “smart goals” feature to help you achieve your financial objectives.

Pricing

- Monarch Money: Offers a free plan with limited features and a premium plan with more advanced tools for a monthly or annual fee.

- Copilot: Currently free during its beta phase, with potential for paid plans in the future.

Table: Monarch Money vs. Copilot Comparison

| Feature | Monarch Money | Copilot |

|---|---|---|

| Budgeting | ✓ | ✓ |

| Expense Tracking | ✓ | ✓ |

| Investment Tracking | ✓ | ✓ |

| Net Worth Tracking | ✓ | ✓ |

| Custom Categories & Rules | ✓ | ❌ |

| Automatic Categorization | ✓ | ❌ |

| Shared Finances | ✓ | ❌ |

| Bill Reminders | ✓ | ❌ |

| Financial Coaching/Education | ✓ | ❌ |

| Visual Budget Dashboard | ❌ | ✓ |

| Spending Trends Analysis | ✓ | ✓ |

| Autopilot Feature | ❌ | ✓ |

| Smart Goals | ❌ | ✓ |

Choosing the Right App

The best app for you depends on your individual needs and preferences. Consider these factors when making your decision:

- Level of Detail: If you need detailed budgeting and investment tracking, Monarch Money might be a better fit.

- Simplicity: If you prefer a visually appealing and easy-to-use interface, Copilot could be a good choice.

- Budget: If you’re on a tight budget, Copilot’s free beta version might be attractive, but be aware that it might eventually become a paid service.

- Financial Goals: Choose the app that aligns with your financial goals, whether it’s budgeting, saving, investing, or all of the above.

Understanding Monarch Money and Copilot

When choosing a budgeting app, it’s crucial to consider the tools and features that will meet your financial tracking needs. Both Monarch Money and Copilot offer robust solutions but in distinct ways.

Key Features of Monarch Money

Monarch Money serves as an all-in-one financial platform aimed at a broad audience, including beginners, students, and businesses. It stands out for its cross-platform support and customer service. Users benefit from its comprehensive tools for:

- Budgeting: Set and adjust personal financial goals.

- Expense tracking: Categorize and manage daily spending.

- Investment tracking: Monitor various investment accounts.

- Insights: Provide an overview of your financial health.

Key Features of Copilot

Copilot, known for its user-friendly approach and aesthetic interface, caters to modern tech-savvy users. With a focus on Mac users, its key features include:

- AI-driven insights: Personalize spending patterns and predictive analytics.

- Budgeting tools: Customizable budget creation based on past spending.

- Real-time tracking: Update accounts and transactions instantly.

- Interface: A visually pleasing design that enhances the overall experience.

Comparing Budgeting and Expense Tracking

Comparisons of Monarch Money and Copilot reveal each app’s strengths in managing finances. Both apps allow users to track and manage expenses effectively, yet they have different approaches.

Monarch Money emphasizes comprehensive financial management across various devices, with a significant focus on user support and development speed. It provides a reliable platform for establishing savings goals and offering financial insights without a steep learning curve.

Copilot’s strengths lie in its polished appearance and AI enhancements, which appeal to users looking for an engaging interface. The AI-driven features suggest actionable financial strategies based on spending patterns and aid in refining savings and budgeting plans.

By examining these offerings, individuals can select an app that not only fits their lifestyle but also empowers them to reach their financial objectives with confidence and clarity.

The Role of AI and Integration in Personal Finance

The integration of AI in budgeting apps has transformed the way we manage money. Coupled with robust integration capabilities, today’s personal finance apps offer more than just basic tracking—they adapt to individual financial patterns and connect seamlessly with a wide array of financial institutions.

AI-Driven Features in Budgeting Apps

Artificial intelligence (AI) has become a cornerstone in the development of personal finance apps. By using AI, apps like Copilot provide personalized insights into users’ spending habits. They sort through financial data, categorize transactions, and make sense of spending trends, which in turn helps users to take charge of their financial wellness. For example, AI can predict upcoming bills and forecast future spending based on past behavior, making money management more efficient and proactive.

- Predictive Budgeting: AI anticipates regular payments and suggests budget adjustments.

- Spending Insights: Users receive breakdowns of spending by category, showing where money goes.

Integration with Financial Institutions and Tools

A key strength of modern budgeting apps is their compatibility with various financial accounts and tools. This integration ensures that comprehensive financial data is available in one place, simplifying the user experience. Users can link their bank accounts, credit cards, loans, and even investment portfolios to apps like Monarch Money and Copilot, allowing for an up-to-date view of their entire financial life. The ease with which these apps connect to financial institutions speaks to the advancements in technology and the heightened expectations users have for a seamless mobile app experience.

- Account Compatibility: Connects with banks, credit cards, and investment accounts.

- Automatic Updates: Financial data syncs in real time, providing the latest balance and transaction information.

Analyzing User Experience and Customization

Choosing between Monarch Money and Copilot means looking closely at how they handle user experience and customization. Users want apps that are not only easy to operate but also allow for a personal touch and protect their information.

Ease of Use and Accessibility

Monarch Money offers a user-friendly platform that even beginners can navigate with ease. The app is designed to make it straightforward for users to establish custom budgets and oversee their financial details. They can do this with just a few taps, whether on iOS or through a web interface. Copilot also provides a seamless user experience, focusing on personalized insights for tracking spending and financial health, categorizing daily and business expenses with precision.

Customization and Personalization Options

Personalizing the financial tracking experience is essential for many users. Monarch stands out with its thorough categorization capabilities, including the use of tags. These tags are handy for marking special cases like split transactions. Copilot, while not supporting as depth in tagging, is praised for its fit to individual users’ thinking patterns regarding money management. Both apps offer custom dashboards, which let users prioritize the info they see first, including net worth tracking and spending analysis.

Security and Privacy Considerations

When it comes to handling sensitive financial data, both Copilot and Monarch Money take security seriously. They ensure users’ financial details are kept safe from unauthorized access. Privacy is also a critical priority, with both apps delivering an ad-free experience to ensure a focus on user data protection. The apps integrate robust measures to guard against data breaches, instilling confidence in users about the treatment and security of their financial information.

Frequently Asked Questions

Navigating the sea of personal finance apps can be quite the challenge. This section breaks down the frequent queries users have when comparing Monarch Money and Copilot, two popular financial tools.

What are the main differences between Monarch Money and Copilot in terms of features?

Monarch Money offers robust support for transaction custom rules, while Copilot shines with its AI-driven insights that cater to personal spending patterns and intuitive interface.

How do the costs of Monarch Money and Copilot compare?

While both apps come with their own cost structures, Monarch Money and Copilot are subscription-based services. Specific pricing can vary, and it’s best to check the latest on their websites.

What are user reviews saying about Monarch Money and Copilot?

Users have noted that Copilot’s design is polished, but Monarch tends to be easier to use practically. Both apps have been mentioned for their stability in connection but differ in user support and transaction features.

Which app, Monarch or Copilot, offers better security for my financial data?

Security is a top concern for both apps. They both use industry-standard encryption to protect user data, but the finer security details might differ and should be reviewed in their terms of service.

How do Copilot and Monarch Money’s budgeting tools contrast with each other?

Copilot is designed with tailored budgeting and financial goals in mind, while Monarch provides a more generalized approach with powerful categorization capabilities.

What are the advantages of choosing Copilot over Monarch Money?

Copilot stands out with its personalized approach to budgeting, offering AI-driven insights, ad-free experience, and a tailored interface for users looking for investment tracking and easy categorization of expenses.