Monarch Money is a budgeting app that helps people track their finances. Many want to know how much it costs before signing up. Monarch Money costs $99.99 for a yearly plan or $14.99 for a monthly plan.

The app offers a free trial for new users. This lets people test the features before they pay. Some users may find special deals that cut the price. For example, Monarch often gives new customers 30% off their first year.

Monarch Money has no free plans. But it does let users add family members at no extra cost. This can be useful for couples who want to manage money together. The app also works with financial advisors, which some users may like.

Monarch Money offers two straightforward pricing plans:

- Monthly Plan: $14.99 per month

- Annual Plan: $99.99 per year (equivalent to $8.33 per month)

As you can see, the annual plan offers significant savings compared to the monthly plan.

Here’s a table summarizing the pricing:

| Plan | Price |

|---|---|

| Monthly | $14.99/month |

| Annual | $99.99/year ($8.33/month) |

Things to keep in mind:

- Free Trial: Monarch Money offers a 7-day free trial to test out the features before committing to a paid plan.

- No Contracts: You can cancel your subscription at any time.

- Promotional Codes: Occasionally, Monarch Money may offer discounts or promotional codes. Keep an eye out for these on their website or through other financial websites.

Is Monarch Money worth the cost?

That depends on your individual needs and how much value you place on its features. If you’re looking for a comprehensive budgeting tool with advanced features like net worth tracking, investment tracking, and detailed financial analysis, Monarch Money could be a worthwhile investment.

However, if you’re on a tight budget or primarily need basic budgeting functionality, there are free or less expensive alternatives available.

Ultimately, the best way to decide is to take advantage of the free trial and see if Monarch Money meets your needs and justifies the cost.

Key Takeaways

- Monarch Money has yearly and monthly paid plans

- New users can try the app for free before buying

- The app allows multiple users on one account at no extra cost

Understanding Monarch Money

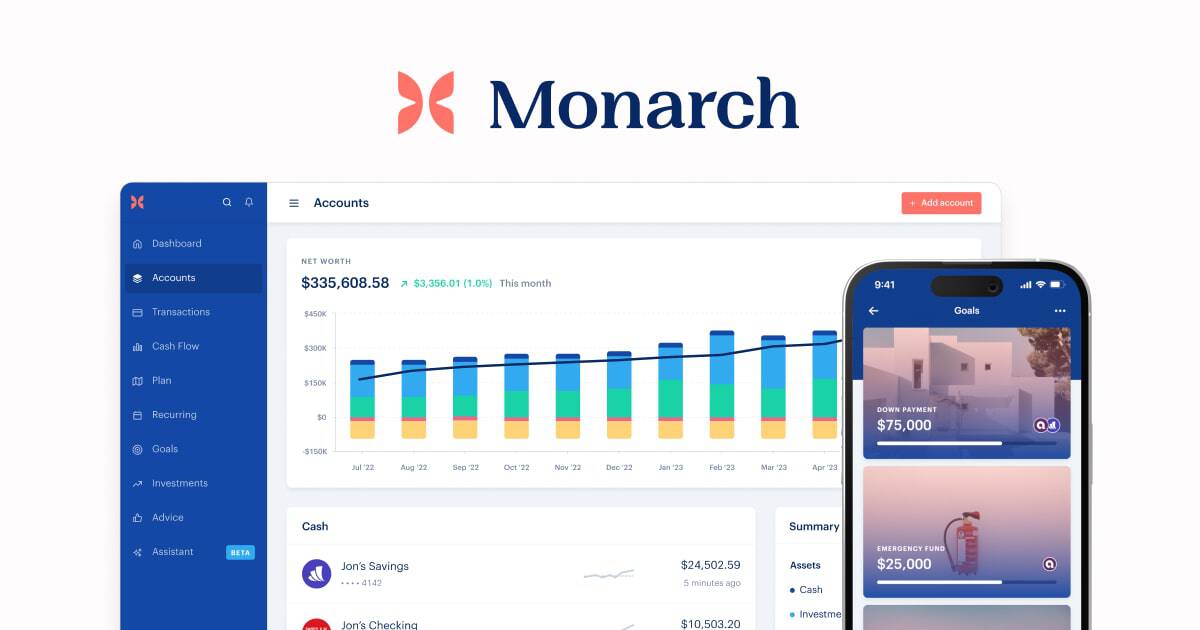

Monarch Money is a financial management tool with features for budgeting, tracking investments, and setting financial goals. It offers both monthly and annual subscription options with a free trial period.

Key Features and Functionalities

Monarch Money provides a customizable dashboard for users to view their finances at a glance. The app tracks net worth by linking various financial accounts. Users can monitor investments and cash flow in real-time.

The platform includes tools for managing recurring bills and creating transaction rules. This helps automate expense categorization and simplifies budget tracking.

Monarch Money’s mobile app allows users to check their finances on the go. The app syncs data across devices, ensuring up-to-date information is always available.

Subscription Options and Fees

Monarch Money offers two main subscription plans: monthly and annual. The monthly plan costs $14.99, while the annual plan is priced at $99.99 per year.

New users can try Monarch Money through a free trial. The trial period may vary, with options including a 7-day or 30-day free trial.

After the trial, users must choose a paid plan to continue using the service. The annual plan offers savings compared to paying monthly.

Setting Financial Goals with Monarch Money

Monarch Money helps users set and track financial goals. The platform allows for creating both short-term and long-term objectives.

Users can set savings targets, debt payoff goals, or investment milestones. The app provides visual progress tracking and offers suggestions to help reach these goals.

Monarch Money uses rollover budgeting. This feature allows unused funds from one month to be added to the next month’s budget, providing flexibility in financial planning.

The goal-setting tools integrate with the app’s other features, giving users a comprehensive view of their financial progress.

Integrations and Security

Monarch Money offers robust integrations with financial institutions and prioritizes user security. The app provides features for syncing accounts, protecting data, and enabling collaboration.

Syncing Financial Accounts

Monarch Money connects to over 11,000 banks and financial institutions. Users can link various account types:

- Bank accounts

- Credit cards

- Investment accounts

- Loans

- Cryptocurrency wallets

The app uses Plaid as its main data aggregator. This allows for quick and secure account syncing. Users can easily view balances and transactions from multiple sources in one place.

Safety Measures and Data Privacy

Monarch Money takes user privacy seriously. The app employs several security features:

- Bank-level encryption

- Read-only access to financial data

- Multi-factor authentication

These measures help protect sensitive information. Monarch Money does not store bank login details. Instead, it uses secure third-party services like Plaid, Finicity, and MX to handle data connections.

Collaboration and Multi-User Access

The app supports shared finances through its collaboration features. Users can:

- Invite family members or partners

- Set custom access levels

- Work together on budgets and goals

This makes Monarch Money useful for couples and households. Each user gets their own login. They can view shared information while keeping some details private.

Frequently Asked Questions

Monarch Money offers a paid subscription service with various features. Users often have questions about costs, discounts, and comparisons to other platforms.

What are the subscription fees for Monarch Money?

Monarch Money has two main pricing options. Users can pay $14.99 per month for a monthly subscription. For those who prefer an annual plan, the cost is $99.99 per year.

The yearly plan offers savings compared to the monthly option. It breaks down to about $8.33 per month when paid annually.

Can students access Monarch Money at a discounted rate?

Monarch Money does not currently offer student discounts. All users pay the same rate for the service.

The company sometimes runs promotions for new customers. These deals may include discounts or extended trial periods.

How does Monarch Money’s pricing compare to YNAB?

Monarch Money and YNAB (You Need A Budget) have different pricing structures. YNAB tends to be more expensive than Monarch Money.

YNAB charges about $99 per year or $14.99 per month. Monarch Money costs $99.99 annually but offers a lower monthly rate of $14.99.

Are there any free trial options available for Monarch Money?

Yes, Monarch Money typically offers a free trial for new users. The standard trial period is 7 days.

Sometimes, special promotions extend the trial to 30 days. These longer trials give users more time to test the platform.

What are the safety and security features of Monarch Money?

Monarch Money uses bank-level encryption to protect user data. This includes 256-bit encryption for all stored information.

The platform also employs two-factor authentication. This extra step helps prevent unauthorized access to accounts.

What limitations should users be aware of when using Monarch Money?

Monarch Money requires a paid subscription. There is no free version of the service available.

Some features may work better on the web version than the mobile app. For example, certain promotions are only redeemable through the website.